Is Accounting 0985 May-June 2023 CIE Past Papers helpful?

IGCSE Accounting 0985 May-June 2023 (9-1) exams were conducted in May-June for those students who prepared their specimens before May. IGCSE Accounting 0985 final exams were conducted on 19 May 2023 by Cambridge. Its grading scheme is 9 to 1. Its threshold was designed to enable me to cover all the essential topics before appearing in the final examination in May-June. The first assessment module in the May-June examination was based on conceptual learning. The second module comprises practical concepts. I also prepare Accounting 0985 Oct-Nov 2023 past papers.

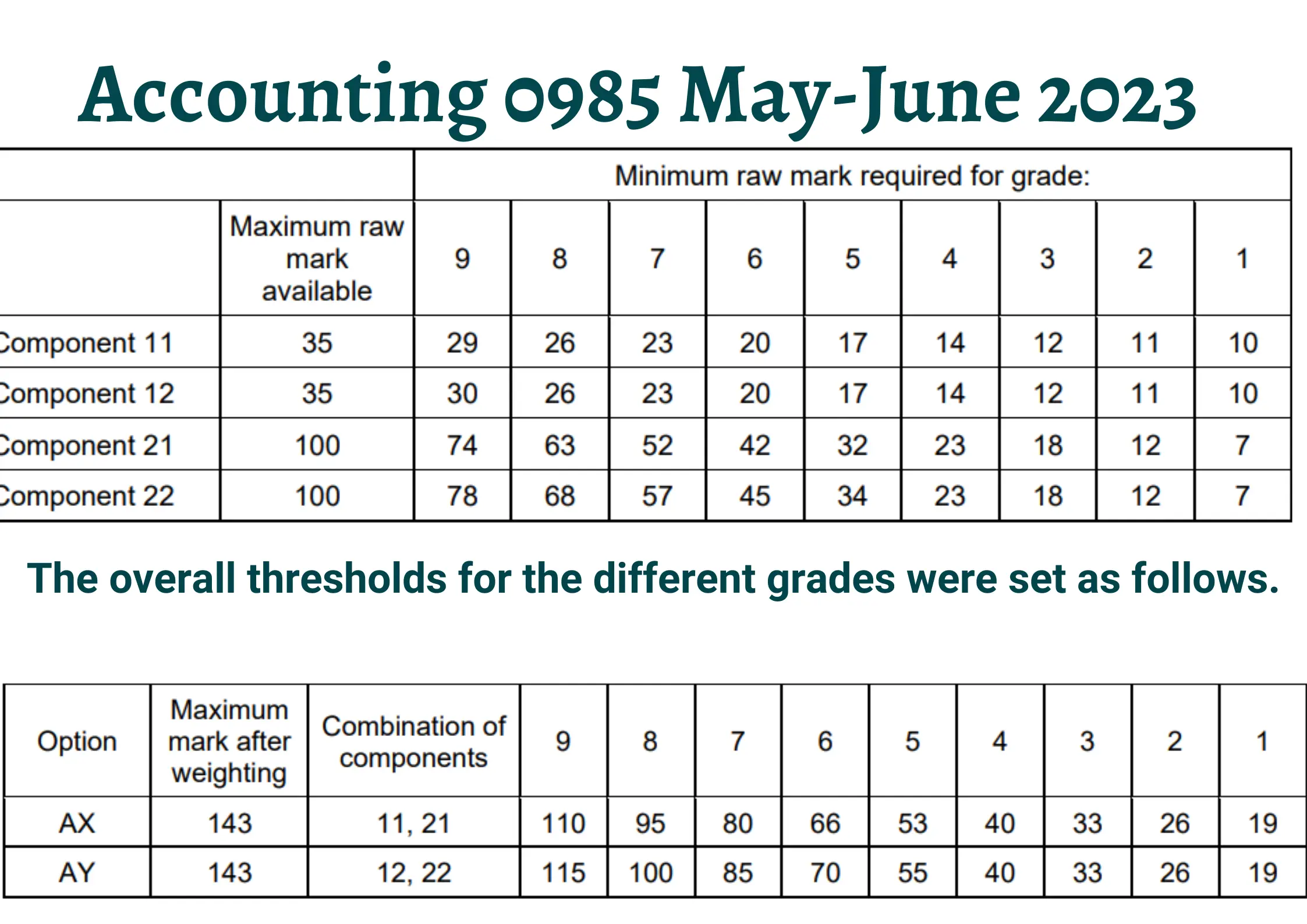

Accounting 0985 May-June 2023

To prepare for the annual IGCSE examination, I first designed essential topics, discussed them with teachers, and tested my knowledge with the help of past papers. These past papers helped me to get high scores in IGCSE final examinations. I understand the grading threshold and prepare specimens accordingly. I tested my knowledge with these papers and improved those topics. With this strategy, I can easily achieve high grades in the final examination. For better results in Accounting 0452, you should also prepare Accounting 0452 past papers.

Accounting 0985 May-June 2023 Grading Threshold

The grading threshold followed for the IGCSE Accounting 0985 annual examing conducted in May-June by Cambridge was arranged for teachers and candidates to have an idea of annual examinations. Students can achieve high grades with the help of a designed grading threshold. With the help of the grading threshold, I got an idea about the weight of each topic or question. The grading threshold designed by Cambridge for the annual examination of May June 2023 is

The grading threshold of the Accounting 0985 May-June 2023 examination is comprised of 4 components that are component 11, component 12, component 21, and component 22. The maximum marks for component 11 and component 12 are 35. If you gain 23 marks you can gain a grade A, for grade B you have to gain 19 marks, if you gain 15 marks you are assigned a C grade. Grade D is assigned on 13 marks. For 12,11 and 10 marks grades E, F and G are allotted respectively.

The maximum marks for Component 21 and Component 22 are 100. If you gain 60 marks you can gain a grade A, for grade B you have to gain 44 marks, if you gain 28 marks you are assigned a C grade. Grade D is assigned on 23 marks. For 15,10 and 6 marks grades E, F and G are allotted respectively. Maximum marks for AX are 143 for components 11 and 21. You can gain a grade A if you score 109 marks out of 143. Maximum marks for AY are 143 for components 12 and 22. You can gain a grade A if you score 109 marks out of 143.

Marking Scheme Paper 1 (Accounting 0985 May-June 2023)

Paper 1 of Accounting 0985 May-June 2023 consisted of 35 marks. All the questions in this paper were compulsory. students have to attempt all the questions. Each question carried equal marks. The paper was comprised of Multiple choice and the mark of each question is 1. The solution of this paper helped me a lot to prepare all those important topics that I should prepare to achieve high grades in paper 1. With the help of a marking scheme, I can easily prepare myself for the final examination.

Marking Scheme Paper 2 (Accounting 0985 May-June 2023)

Paper 2 of Accounting 0985 May-June 2023 consists of 100 marks. I prepared detailed questions to gain high grades in this paper. I first understand its marking scheme that enables me to divide the specimen accordingly. I focused on those topics in which I could easily achieve high scores with little effort. This paper is based on practical and theoretical questions that enabled me to solve complex problems easily.

GENERIC MARKING PRINCIPLE 1

Marks for Accounting 0985 May-June 2023 must be awarded in line with:

- the specific content of the mark scheme or the generic level descriptors for the question

- the specific skills defined in the mark scheme or the generic level descriptors for the question

- the standard of response required by a candidate as exemplified by the standardisation scripts.

GENERIC MARKING PRINCIPLE 2

Marks awarded are always whole marks (not half marks, or other fractions).

GENERIC MARKING PRINCIPLE 3

Marks must be awarded positively:

- marks are awarded for correct/valid answers, as defined in the mark scheme. However, credit is given for valid answers which go beyond the

scope of the syllabus and mark scheme, referring to your Team Leader as appropriate - marks are awarded when candidates demonstrate what they know and can do

- marks are not deducted for errors

- marks are not deducted for omissions

- answers should only be judged on the quality of spelling, punctuation and grammar when these features are specifically assessed by the question as indicated by the mark scheme. The meaning, however, should be unambiguous.

GENERIC MARKING PRINCIPLE 4

Rules must be applied consistently, e.g. in situations where candidates have not followed instructions or in the application of generic level

descriptors.

Presentation of the mark scheme

Slashes (/) or the word ‘or’ separate alternative ways of making the same point.

- Semi-colons (;) bullet points (•) or figures in brackets (1) separate different points.

- Content in the answer column in brackets is for examiner information/context to clarify the marking but is not required to earn the mark

(except Accounting syllabuses where they indicate negative numbers).